ANALYSIS: As had been widely anticipated, the Reserve Bank has just left its Official Cash Rate unchanged at the 3.25% rate they took it to at the previous meeting of the Monetary Policy Committee late in May. They didn’t provide any updated forecasts at this review but noted that if things pan out as they expect then there is scope for interest rates to go lower as they outlined back then.

What they have pencilled in is a cut in the cash rate to 3% before the end of the year with a small chance of a cut to 2.75%. Why not cut now when it is clear to many people that the economy is not strong?

Partly it is because in the next six months the annual rate of inflation is widely forecast to rise from the current 2.5% to 3% if not a tad higher. This will reflect things like higher power prices and food prices in particular. We will get the inflation number for the year to June on July 21.

The problem here is that despite the economy having spare capacity (as in the unemployment rate being 5.1%), there have recently been increases in some key gauges of what inflation might do down the track.

Start your property search

The ANZ’s Business Opinion Survey showed a year ago that a net 35% of businesses planned raising their selling prices in the coming year. Now that proportion is 49% driven probably substantially by a net 79% expecting their costs to rise through to mid-2026 and margins currently being exceptionally tight.

We have also seen a slight lift in household inflation expectations and the risk I’ve been highlighting for some time is that once consumers start spending a bit more over 2026 businesses will take advantage of that to raise prices and recover lost margins.

Throw in uncertainty related to the global environment for inflation and growth, where our export prices might be headed, how easing fiscal policies offshore may affect things, and how long wages growth in New Zealand remains restrained and get a very clouded picture.

Discover more:

- Mega-mortgagee sale: Who has $60m to buy an entire apartment block?

- Tony Alexander: Supply and demand 101 - buyers to reign until 2026

- Rich-lister pays more than $17m to buy houses next door to her mansion

The things I focus on substantially are high business pricing plans for a year from now, loosening fiscal policy in the United States and upward pressure on global medium to long-term interest rates, plus the lesson our Reserve Bank recently learnt from easing policy too much during and after the pandemic.

For borrowers the situation looks like one in which tossing a coin between fixing, one, two, or three years for the remainder of the year may be the optimal tactic. Actually, one is incentivised in this environment to fix for two or maybe three time periods in order to spread risks out and buy time to adjust one’s budget should shocks up or down come along.

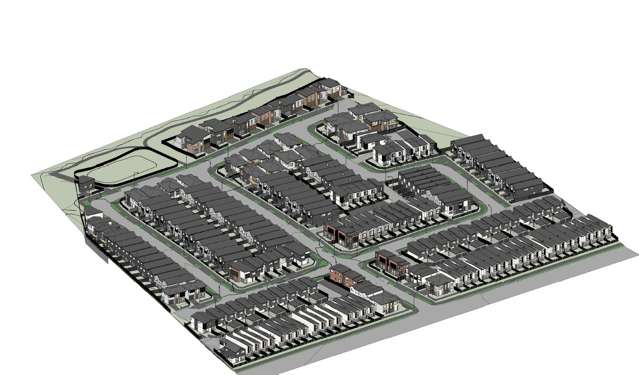

For the housing market there was nothing in today’s cash rate review from the Reserve Bank to justify any change in view for where the market is headed. Buyers remain cautious with minimal feelings of FOMO. Listings are at a 10-year high, issuance of consents for more dwellings to be built are unusually strong, some older investors are selling because of higher costs, and levels of job security remain low.

Independent economist Tony Alexander: "There was nothing in today’s cash rate review from the Reserve Bank to justify any change in view for where the market is headed." Photo / Fiona Goodall

We are in a very solid buyer’s market, and we can see from various measures that first-home buyers recognise this and are taking advantage of the situation to make a purchase. Frankly, much as some people may bemoan the lack of rising house prices currently and the associated lack of extra household spending from perceptions of higher paper wealth, this is a very good development.

The back of exceptionally poor housing affordability in New Zealand may finally have been broken. But a return to the pre-1990s scenario of prices averaging just three times average income is not on the cards – not with construction costs having skyrocketed in the past three decades.

- Tony Alexander is an independent economics commentator. Additional commentary from him can be found at www.tonyalexander.nz