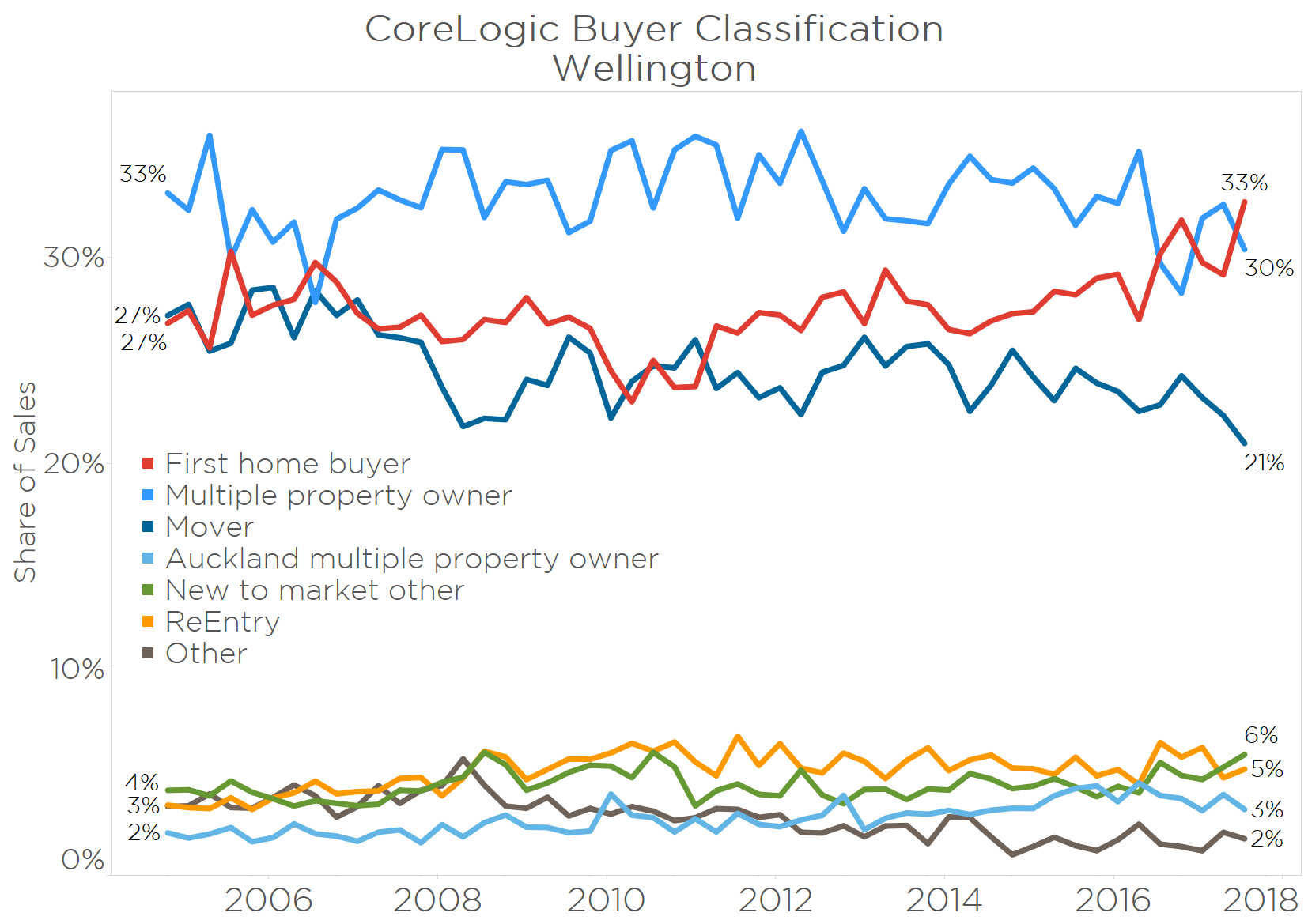

A greater proportion of property buyers in Wellington are now first home owners than investors.

It’s the first time in a decade that those getting into their first home have had the edge on investors, and the statistic makes Wellington a standout among the other major cities where investors beat first time owners in every case.

CoreLogic figures show that in the Capital 33 per cent of purchasers are first home owners, while 30 per cent are investors. Compare this to Auckland where just 23 per cent of buyers are in the first home owning category and a whopping 44 per cent are investors.

Start your property search

It begs thequestion: Is Wellington a first home buyer’s paradise?

Some argue thatWellingtonians have a leg up on other urban dwellers because their salaries tendto be higher while houses are still relatively affordable. Wellington’s averagehousehold income is $119,575 and its ratio of housing costs to household incomeis 14.7, compared with the rest of New Zealand’s average of $104,023 and ahousing costs/income ratio of 15.8.

Rob Garlick,general manager of Ray White Wellington and a veteran of the city’s real estateindustry, is not so sure Wellingtonians have it easy.

“Outside ofAuckland, where there’s a particular crisis, I would say the challenges firsthome buyers face are uniform across the country,” he says.

Wellingtonbuyers may have a marginal salary advantage, but they still have the problem ofrising property prices and lack of stock, and the loosening in the LVRrestrictions will make little difference, he says.

Others saywhile the central city from Khandallah to Seatoun may be out of reach for mostfirst home owners, there is good value to be had in the Capital’s outlyingareas.

Tommy’s realestate agent Euon Murrell specialises in the city’s north, and says the suburbsbetween Tawa and Pukerua Bay are “an untapped jewel”.

Areas such asPorirua have a connotation in buyers’ minds, but have plenty to offer includingaccess to beaches and a rail link into the city, he says. “Once people movehere they love it so much they just upgrade within.”

The figuresbear him out. Ascot Park, to the north of Porirua City, is first home country –60 per cent of its purchasers in 2017 were taking their initial step onto theproperty ladder paying a median price of $401,000, CoreLogic says.

Murrellrecently received eight offers for a three-bedroom, one-bathroom home in AscotPark which sold for $505,000. “That’s how the market’s going,” Murrell says.

Meanwhile firsthome buyers are also taking a second look at the Hutt Valley.

Not so long agothe older suburb of Petone on the Hutt foreshore was the only area“Wellingtonians” would consider, Mark Coffey, owner of Tommy’s Lower Hutt andUpper Hutt, says.

“They looked atthe Hutt Valley as black t-shirt Boganville,” he says. “But in the last 24months there’s been a complete change in terms of Wellington buyers who rent inthe city and are coming up as far as Upper Hutt. Two years ago, that wasunheard of.”

The sameapplies to the suburbs in central Wellington’s northernmost hills, such as Johnsonvilleand Newlands. The LVR restrictions and the banks’ tighter lending criteria areforcing first home buyers to the Capital’s peripheries to find affordable neighbourhoods,Coffey says.

Once again, thefigures back him up. In Waiwhetu, on the eastern side of Lower Hutt, half ofall buyers in 2017 were first home owners paying a median price of $481,000.

Meanwhile inPaparangi, adjacent to Newlands, 47 per cent of purchasers were in the firsthome buying category paying a median of $590,000, CoreLogic says.

First home buying in the city

Auckland:

· 44%investors, 23% first home buyers, 21% movers

· Mostpopular first home buyer suburb: Wiri – median price paid by first home buyers$569,000.

Hamilton:

· 33%investors, 26% first home buyers, 23% movers

· Mostpopular first home buyer suburb: Fairview Downs – median price paid by firsthome buyers $465,000.

Tauranga:

· 35%movers, 26% investors, 19% first home buyers

· Mostpopular first home buyer suburb: Judea – median price paid by first home buyers$465,500.

Wellington:

· 33%first home buyers, 30% investors, 21% movers

· Mostpopular first home buyer suburb: Ascot Park – median price paid by first homebuyers $401,000.

Christchurch:

· 38%investors, 25% first home buyers, 19% movers

· Mostpopular first home buyer suburb: Bromley – median price paid by first homebuyers $317,500.

Dunedin:

· 32%investors, 26% first home buyers, 23% movers

· Mostpopular first home buyer suburb: Brockville – median price paid by first homebuyers $310,000.