Wellington first-home buyers have been hit the hardest by the post-Covid property boom, new research shows.

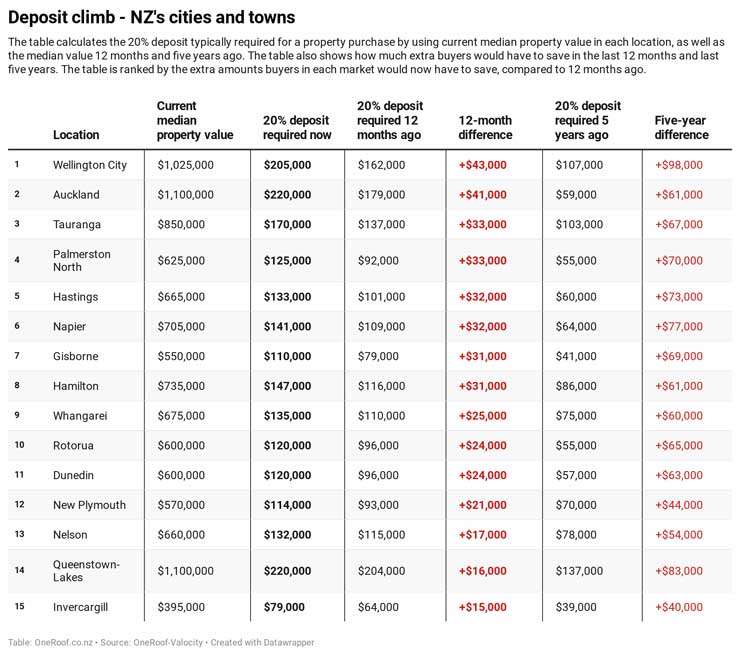

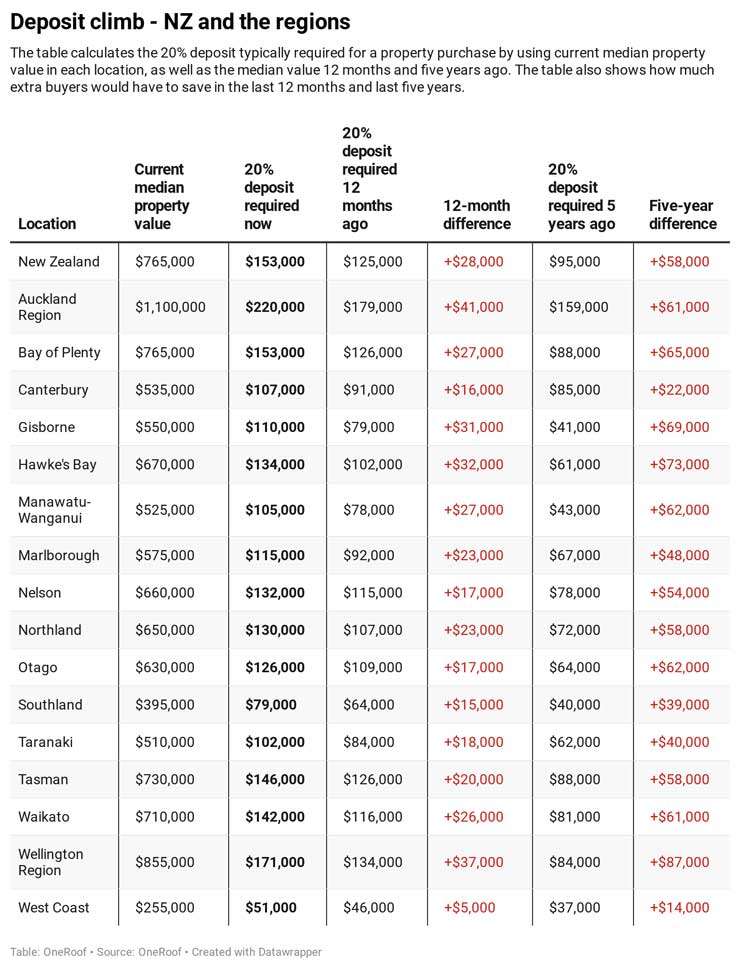

OneRoof has calculated the extra thousands of dollars first home buyers must now save as a result of rising house prices, and found that deposit requirements grew by $28,000 to $153,000 for New Zealand in the last 12 months.

READ MORE: Find out if your suburb is rising or falling

But first home buyers in the capital face an even steeper climb, with the amount they need to save growing $43,000 over the same period to $171,000.

Start your property search

First home buyers in Auckland and Queenstown face the steepest deposit requirement - a high $220,000 - while the lowest deposit needed to buy a home - $79,000 - was in Invercargill.

OneRoof calculated extra money required for a 20% deposit by using the current median property value in each region and comparing it to the median value 12 months ago.

OneRoof editor Owen Vaughan said: "The post-lockdown surge, fuelled by low interest rates, plus the return of the loan to value ratio restrictions, has definitely made it harder for first home buyers. While the cost of servicing a mortgage has never been lower, deposit requirements have never been higher.

"The path to home-ownership is particularly hard in Wellington. Median house prices in the city have broken the $1 million barrier – way above what the Government believes is affordable.

“First home buyers in Auckland are not that much better off. The deposit requirement of $200,000-plus in the city is $41,000 more than 12 months ago and $61,000 more than five years ago.

"Compare that to the situation in Christchurch, where first home buyers in the city would typically only need a $107,000 deposit - up just $27,000 in the last 12 months."

Invercargill is New Zealand’s most affordable city for first home buyers. Photo / Getty Images

The rapid escalation in property values post-Covid has implications for those trying to enter the market in both Wellington and Auckland.

OneRoof defined as affordable in Auckland and Wellington as $650,000 and $550,000 respectively. The sums are the maximum price of a three-bedroom KiwiBuild home in each city and are deemed by the Government as within reach of first home buyers – albeit with a 10% deposit.

The research shows first home buyers in Invercargill and Queenstown Lakes have been the least impacted by the post-lockdown surge, although for different reasons. The typical deposit requirement in Invercargill grew just $15,000 to $64,000, the result of the city’s low median property value of $395,000. Queenstown Lakes’ deposit requirement of $220,000 is joint-highest with Auckland but it is only $16,000 more than the amount required 12 months ago, the result of the city’s economy bearing brunt of the ban on international visitors and house prices struggling post-lockdown.

The number of affordable suburbs in Auckland has shrunk to just eight. Photo / Fiona Goodall

The research found that the number of Auckland suburbs where the median property value is $650,000 or less had shrunk in the last 12 months to just eight - down from 26 a year ago and 47 five years ago - although five of those are in rural areas with few houses.

The number of suburbs while the number of suburbs with median property values of between $650,000 to $900,000 has shrunk from 73 to 38 in the last 12 months.

Even more striking is that 195 Auckland suburbs now have median property values of $1 million or more - representing a staggering 71 % of the city.

House values in the Auckland region grew $205,000 (23%) to a new median of $1.1 million, with typical prices in Auckland City and the North Shore jumping an even higher $255,000. The suburb with the most affordable real estate is Auckland Central, where the median value is $495,000, although most of the homes available are one or two-bedroom apartments.

Vaughan said: “Even parts of Auckland that have been viewed as affordable or low value, such as Mangere and Manurewa, have seen property values jump more than 20% to more than $800,000, with recent auction results showing that $1 million-plus sales in these areas are not uncommon."

In Wellington, where house values have grown $215,000 in the last year, the situation appears even more dire. The number of suburbs with a median value of $550,000 or less had shrunk from three 12 months ago to just one - Wellington Central - while the number of suburbs with median values of $1 million or more jumped from 12 last year to 36, with another eight within striking distance.

Sold stickers on a real estate window in Auckland. Photo / Fiona Goodall

Wayne Shum, senior research analyst at OneRoof's data partner Valocity, said that historically low interest rates and the suspension of the loan to value ratio restrictions for both owner-occupiers and investors had made it more difficult first home buyers to secure a home in Auckland and Wellington.

"In many cases they have been forced to buy in lower priced suburbs, often competing against investors for the same stock. This has pushed many 'affordable' suburbs within reach of a $1 million median property value.

"The lack of listings and the FOMO effect have taken a toll as is evidenced by the big prices seen post-Covid."

Economist Tony Alexander said that first home buyers had not been completely shut out of the market "because the median value is the middle and half the dwellings are valued below that median. But the higher the median, the smaller the number of affordable dwellings available. Choice for first home buyers has collapsed this past year."

Mortgage Lab founder Rupert Gough said the figures were "extremely disappointing" for first home buyers.

"Buyers are being outpaced by purchase prices meaning the deposit requirements are moving faster than most first home buyers can save,” he said.

“The question has to be asked if LVR restrictions needed to be as harsh for first home buyers. Can more money be freed up for high-quality applicants who only have 10-20% deposit? I think it’s something the RBNZ needs to address quickly.”

He added: “First home buyers are going to want to focus on putting money into their KiwiSaver or equivalent Superannuation scheme. It’s one of the few savings methods where an employer will match your savings and you also receive member tax credits. It’s the fastest way to build your deposit. Even that might not be enough in this environment.

“Anecdotally, the numbers are confirmed by the increased use of the Bank of Mum and Dad. It’s extremely difficult for even diligent savers to come up with $205,000.”

OneRoof property commentator and former Property Institute of New Zealand chief executive Ashley Church said the figures demonstrated "the absolute insanity of applying the LVR rules to first home buyers.

"The Government needs to step in, immediately, to sort out this mess in a way which will give first home buyers a chance to buy a home."

Church urged the Government to guarantee "the first 10% or 20% of the purchase price, for first home buyers, for the first five years. This would enable banks to lend to first home buyers with little or no deposit required”.