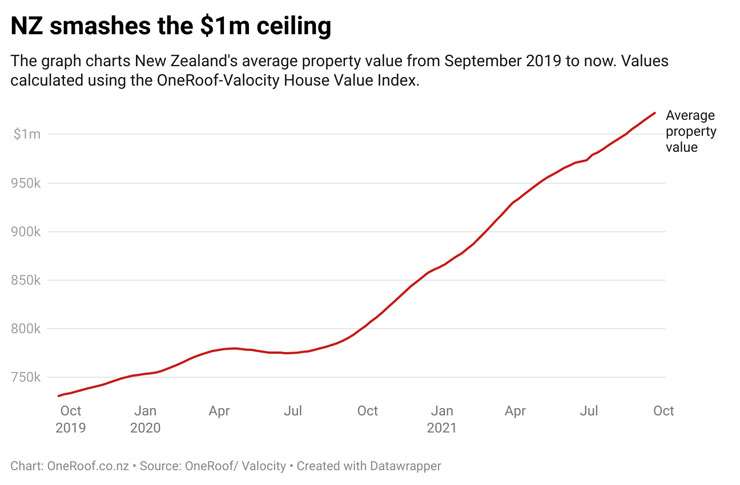

New Zealand house prices are still rising at a sharp rate, but new monthly figures show the foot is coming off the accelerator, albeit slowly.

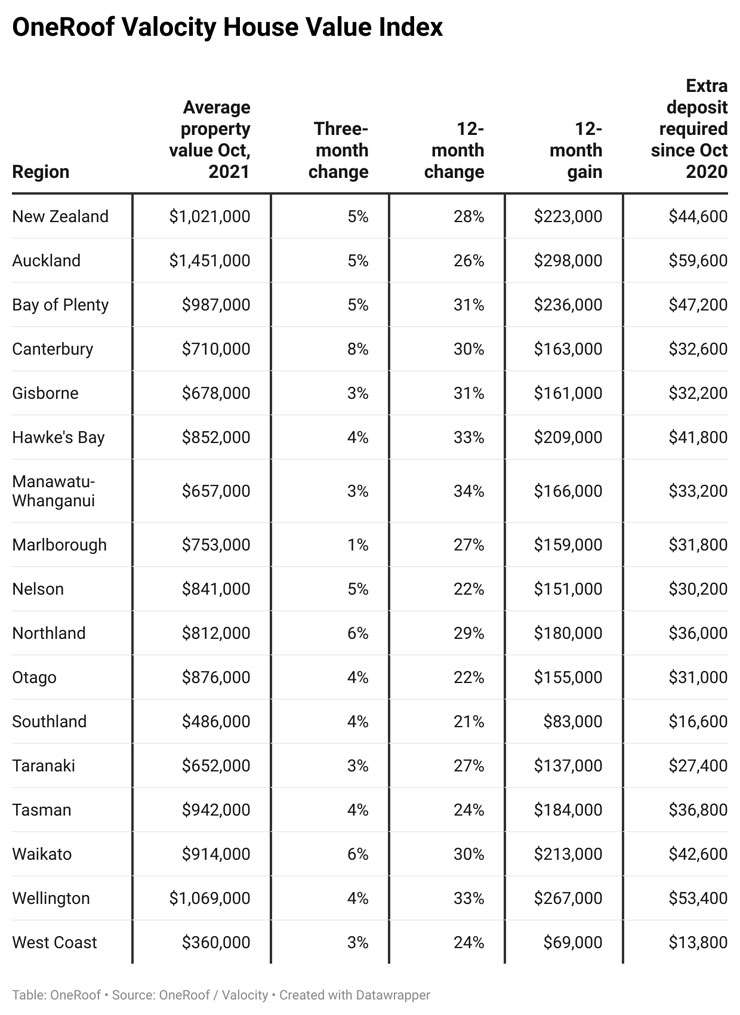

According to the latest OneRoof-Valocity House Index, the average property value for all of New Zealand jumped 5% to $1.021 million in the last three months.

The growth rate is smaller than the 6.1% seen in the previous three-month period, and suggests that prices are starting to ease nationwide.

Start your property search

However, the rise still represents a value bump of $49,000 and covers a period when the housing market has been constrained due to Covid lockdown measures.

The pace of growth slowed in 11 of the country’s 16 regions, with Marlborough registering the biggest decline over the two quarters (from 8.8% to 1.2%) and Southland registering the smallest (4.2% to 3.6%).

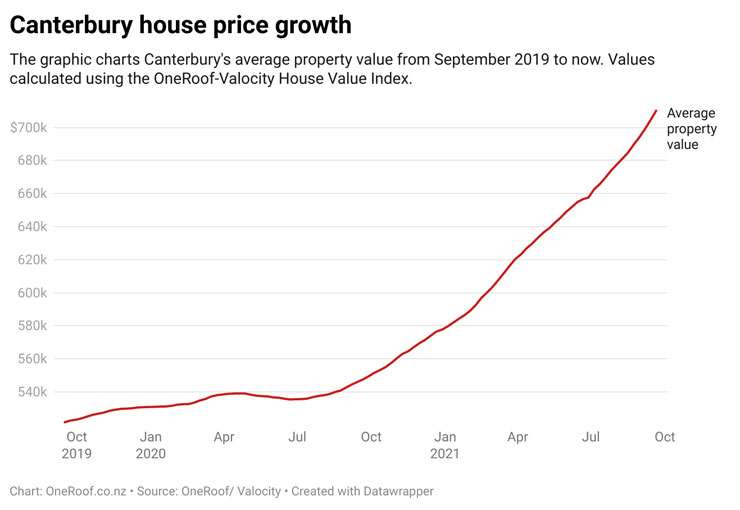

Value growth between the two quarters picked up in Canterbury, Auckland, Otago, Nelson and Northland, although by less than one percentage point.

Just 20 TAs registered a higher rate of growth in the last three months than in the previous three-month period. However, 54 TAs saw growth of more than 3% in the last three months, and only two – South Waikato and Whakatane – saw growth of less than 1%. No region or TA has seen property values fall backwards.

Still momentum in the market

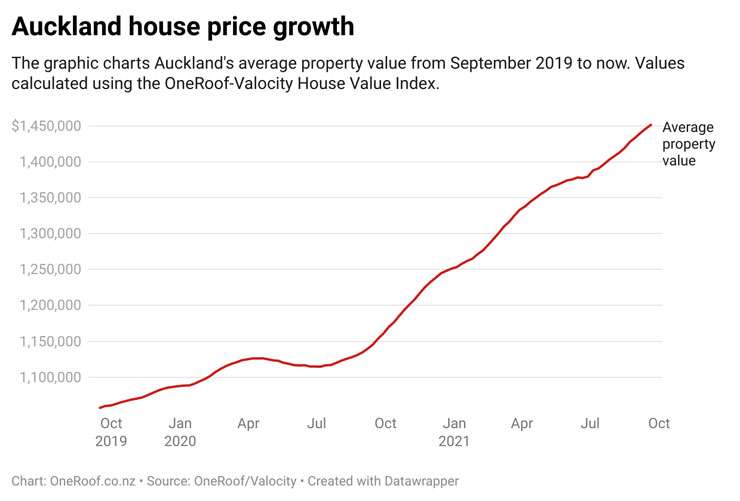

Momentum in the market has seen house prices stretch further out of view for many first-home buyers. Auckland’s average property value is now $1.451m – $74,000 more than what it was three months ago.

The average property value for the entire Wellington region, not just the capital, is now more than $1m, and it won’t be long until Bay of Plenty ($987,000), Tasman ($942,000) and Waikato ($914,000) cross the threshold.

Of the country’s major metros, Christchurch saw the biggest three-month change: its average property value, still the lowest out the seven centres, jumped 8.8% to $718,000. Growth was also strong in Tauranga (up 6.5% to $1.138m), Queenstown-Lakes (up 6.4% to $1.624m) and Hamilton (up 4.7% to $866,000) but was starting to ease in Wellington (up 3.6% to $1.231m).

House price growth in Dunedin remains sluggish, with the city’s average property value up just 2.9% to $717,000, off a 4.2% rise over the previous three-month period.

Beachfront houses in Auckland's St Heliers. High-value homes have seen significant value lifts. Photo / Getty Images

Outside of Auckland, the five TAs that enjoyed the biggest dollar gains over the last three months were: Queenstown-Lakes (up $98,000); Selwyn (up $80,000); Thames-Coromandel (up $79,000); Waipa (up $78,000); and Matamata-Piako (up $75,000).

Also enjoying big gains were Tauranga (up $69,000); Taupo (up $64,000); and Christchurch (up $58,000).

Meanwhile, prices in Whakatane barely shifted, with the last three months adding just $1000 to the average property value.

Queenstown-Lakes is the most expensive city for real estate, although parts of Auckland have a higher average property value: $1.658m for the city’s central suburbs; $1.897m for the North Shore’s beach suburbs; and $1.952m for Waiheke Island.

The cheapest place for property in New Zealand is Buller, on the West Coast. Its average property value is $330,000 – just $40,000 more than the typical deposit required for an Auckland house.

Wellington’s housing market transforming beyond recognition

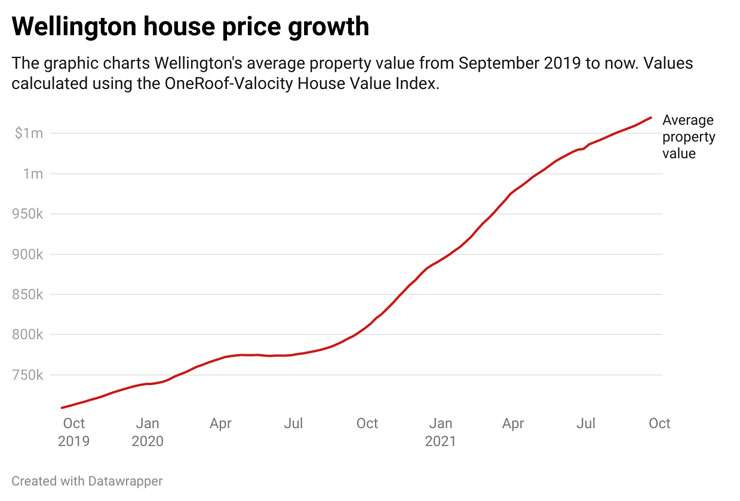

The house price surge has had a transformative effect on several housing markets around the country. The changes in the capital’s housing market are a prime example.

Wellington, long viewed as immune to the price surges that have plagued the Auckland market, is well and truly a $1 million-plus city.

Wellington’s average property value sits at $1.231m, up 30% since October 2020 when the post-lockdown boom began to take effect. That gain is the equivalent of $284,000 on top of the price of an average house in the city – and would require first-home buyers to cough up an extra $56,800 for a typical 20% deposit. Look back five years, and Wellington’s average property value was $668,000 and Auckland’s was just over $1m.

It’s when you look at value growth at a suburb level that you see the big shifts in the city’s housing market. A year ago, 17 Wellington suburbs had an average property value of $1m or more, with typical house prices in the other 39 suburbs under $1m. Now, the number of $1m-plus suburbs sits at 48, and just eight suburbs have an average property value of less than $1m.

For first-home buyers with tight budgets, the solution would be to head to the capital’s fringe towns and regions, but the average property value for the seven other TAs that make up the Greater Wellington region is just over $930,000.

Wellington is not the only major metro to see house prices rise at record rates.

Surprisingly, just 15 of the country’s more than 25,000 suburbs have lost money in the post-Covid boom, most of which are small rural locations with few houses and almost zero sales activity.

A sold sign for Tommy's Real Estate outside a property in the Wellington suburb of Churton Park. Photo / Getty Images

Of the suburbs that saw lifts in their average property value, those in Auckland City and Auckland North Shore enjoyed the country’s biggest windfall ($320,000), while homeowners in Waiwera South, in Clutha, saw the smallest 12-month lift, with the suburb’s average property value rising just $1000 to $274,000. That’s less than half of what Herne Bay, in central Auckland, earned in a day. The country’s most expensive suburb saw its average property value jump $757,000 to $3.781m in the last 12 months.

An extra $2000 a day

Of the 1000-plus suburbs that saw more than 20 sales in the last 12 months, 19 enjoyed value gains of more than half a million dollars. Not all are in Auckland. Four (Matangi, Newstead, Puketaha and Tamahere) are in Waikato; three (Arrowtown, Kelvin Heights and Queenstown Hill) are in Queenstown; and one (Roseneath) is in Wellington.

The overall figures are grim for those who haven’t yet been able to break into the market, and the surge puts the squeeze on those saving for a deposit.

House-hunters are now spending about $223,000 more than they did a year ago on the typical home, and the surge in prices is taking place against a backdrop of a slump in listings.

However, the Reserve Bank’s decision to raise the OCR and tighten lending could curb any post-lockdown jumps.