There’s no doubting the strength of New Zealand's labourmarket and the latest fall in the unemployment rate to 3.9 percent took mostpeople by surprise. That’s the lowest it’s been since the second quarter of2008, just prior to the GFC really taking hold.

The positive picture continues when taking a 12-month view:with the level of employment 3.3 percent higher than the previous period.Clearly, with most people in jobs, this provides plenty of support forproperty.

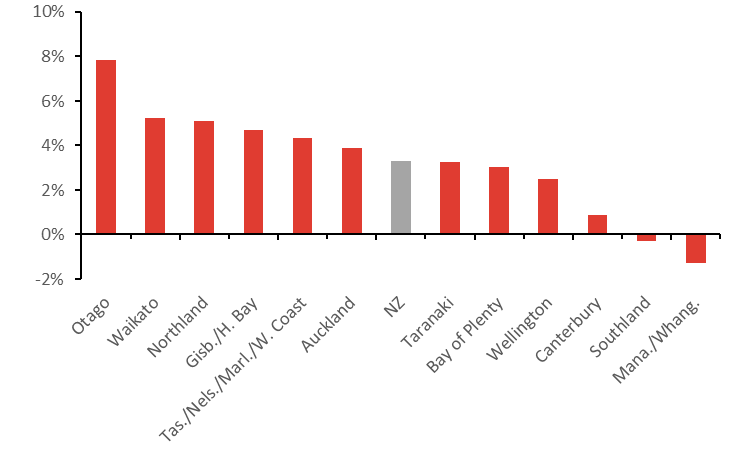

Using employment growth as a measure of momentum in eachregion, the chart below shows just how strong the Otago region’s economy hasbeen recently. It’s also worth noting that, aside from Waikato, the rest of thetop five for employment growth are all regions without a major city, i.e.they’re “provincial” areas. At the other end of the scale, Canterbury has onlyexperienced a small rise in employment lately, while Southland andManawatu/Whanganui have suffered falls.

Employment growth

Start your property search

(% 12-month movingaverage, Source: Statistics NZ)

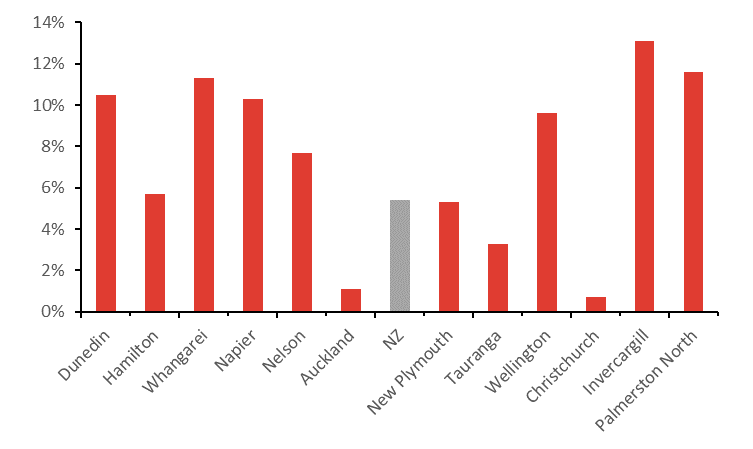

These employment growth patterns help explain recentproperty market performance. Take Otago for example, Dunedin in particular. Asthe next chart shows, its average property value has risen by 10.5 percent overthe past year, almost double the national figure of 5.4 percent.

Annual % propertyvalue growth

(Source: CoreLogic)

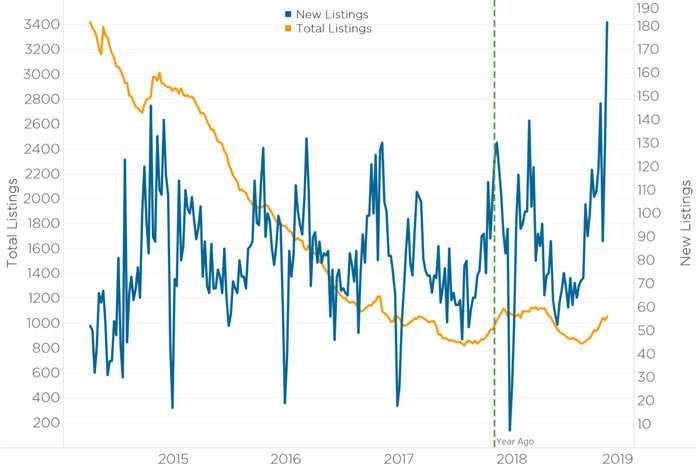

No doubt a strong labour market has been a factor behindthat rise, along with other drivers such as a low level of total listingsacross the wider region (see the last chart chart).

Otago listings

(Source: CoreLogic)

Other areas of interest that these charts raise includeNorthland, Wellington, Southland, and Manawatu-Whanganui. In Northland, strongemployment growth correlates well with the recent gains in property values inWhangarei. But how can we explain the strong value growth in Wellington,Invercargill and Palmerston North, despite subdued gains in employment acrossthe wider regions? In the capital, as we wrote about here, a tight listingssituation is one factor that helps to solve the puzzle.

Southland also has a low supply of property listings, whichwill be bolstering values in its main centre. On top of that, Invercargill’saverage property values themselves are low, at just $280,275 ($400,000 lessthan the national average) and that better affordability gives more scope forgrowth than elsewhere. The same applies in Palmerston North: little propertyavailable to buy and decent affordability (average value is $413,000) will bedriving growth.

Overall, the labour market clearly isn’t the only thing thatdrives property values, but it’s certainly been playing a supporting roleacross the country. It’s slightly unfortunate for borrowers that the lowunemployment rate has reduced the chances of a near-term drop in the OCR(although let’s not get greedy; some mortgage rates are already sub-4 percent),but it’s a job and income that really matter when it comes to servicing themortgage and influencing the wider housing market stability. On this front, NewZealand is looking strong indeed.

Kelvin Davidson is senior research analyst at CoreLogic