ANALYSIS: One of the five surveys I run each month asks consumers about their spending plans for the next three to six months. During the depths of the recession last year, a net 42% of people said that they planned to spend less. This reading improved to a net 10% positive just before Christmas as people responded positively to interest rate cuts. However, the cuts haven't been the economic panacea many were hoping for, and the survey reading fell back to a net 18% planning to spend less in April.

Since then, things have been slowly improving, and the results of my latest survey show that a net 1% of consumers plan to curtail their spending in the months ahead. That won’t save many in retail who have been holding on for a recovery in consumer spending, but the direction of travel is what really matters, and things are getting better.

We should approach with caution any talk of an economic revival. When we look at individual categories of spending, the outlook is still quite bleak for some sectors. For instance, a net 14% of people say they plan to spend less on furniture and appliances – the market which Smiths City Market and Kitchen Things played in.

Discover more:

Start your property search

- Tony Alexander: The fear factor behind NZ's latest house price slump

- Influencer looking to trade his way from a paperclip to a house

- TV star pad: Some houses are 'boring as bats***', but not this one

A net 16% of people also plan to spend less on eating out. That means hard times continuing for cafes and restaurants, though one’s profitability in this sector depends strongly on two things. The demographic one serves and one’s ability to control costs. Some operators who mainly service the older age group seem to still be doing quite well.

I ask two questions about housing in my spending surveys. The first is about whether people will spend more or less on a house to live in. This measure was firmly positive from my first survey in June 2020 until February 2022. Since then, it has been in negative territory, with the worst reading being a net 9.8% of people in June last year saying they planned to spend less.

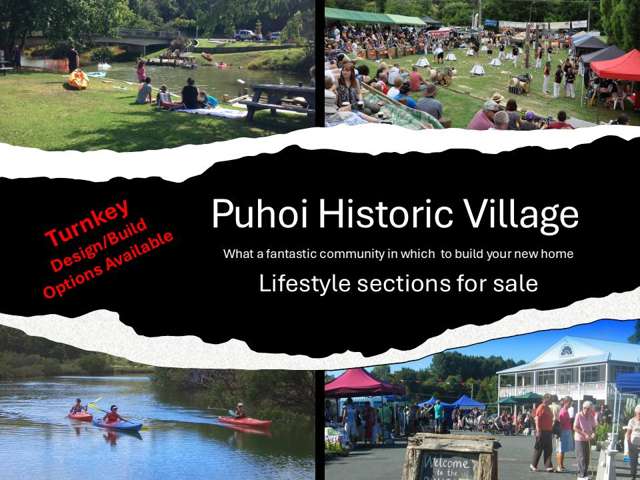

The most recent reading is a net 3.1% planning to spend less, which is still negative and tells us that the market will take time to fire up as we head into spring. But the trend for three months has been towards the positive, which suggests summer will bring some stronger housing market conditions. That is something important for home builders and developers of residential subdivisions.

Independent economist Tony Alexander: Summer may bring some stronger housing market conditions. Photo / Fiona Goodall

I also ask people if they plan to buy an investment property. This measure was positive from June 2020 until April 2021 and has been net negative ever since. The worst reading was again in June last year, with a net 18.7% saying no (net selling in other words). The measure has improved over the last three months, but still sits at -9.4%.

Much is being written in newspapers regarding investors doing more buying and I can tell from my other surveys that there definitely are old hands out there buying and newbies making purchases as well. But my survey also captures those who already hold property and the message from this survey as well as the one I run of existing investors with Crockers Property Management is that many probably older investors are looking to sell to help finance their more-expensive-than-expected retirement. That includes money to buy scones and corn fritters in their favoured cafes where they and their friends tend to meet these days.

- Tony Alexander is an independent economics commentator. Additional commentary from him can be found at www.tonyalexander.nz